My whole family is buried in a tiny, quiet, 330-year-old cemetery just outside of Chestertown, Maryland. The notable exception and still-living member is my mom, Brenda, about whom I frequently overshare. Today is no exception. (You thought I was going to come back from our holiday break and write a normal lede? That I’d just jump right into an update post without a weird and personal anecdote that makes you think, “she thought this was the right tone to hit on a Friday morning? I have to drink my coffee and read about this girl’s dead family before I start mentally planning my weekend? What does this have to do with house hunting?”)

And to be fair, that’s probably the rational response. But a few weeks ago, when my mom and I passed through Chestertown on our way to scrape algae blooms off headstones with our fingernails (festive, huh?), Brenda hit me with a new question for the first time: “if it’s still light out when we’re done, do you want to see the places where dad and I used to live?”

DUH. Of course I did. So after we’d finished scratching gunk off granite, wiping down graves with bottles of water and paper towels (her), and hammering big holiday arrangements on top of each plot with long, old nails (me), Brenda drove a little deeper into the country. She pointed out former homes and told me stories about old landlords or the neighbors who used to watch me when I was a baby. And then, nonchalantly, as we were about to make a right turn, she gestured at an old gate guarding a long driveway up ahead and said, “that was the mansion we bought at auction.”

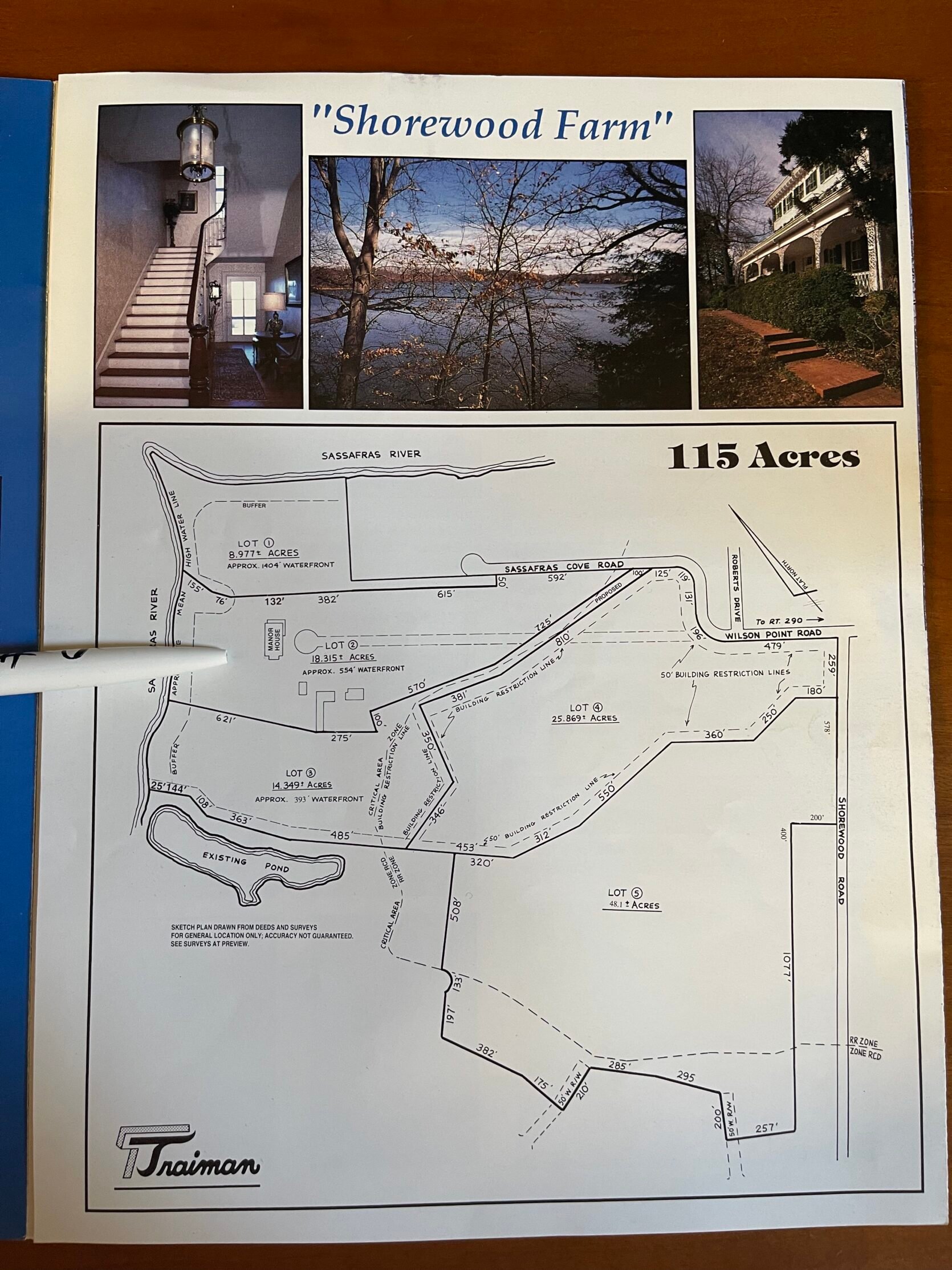

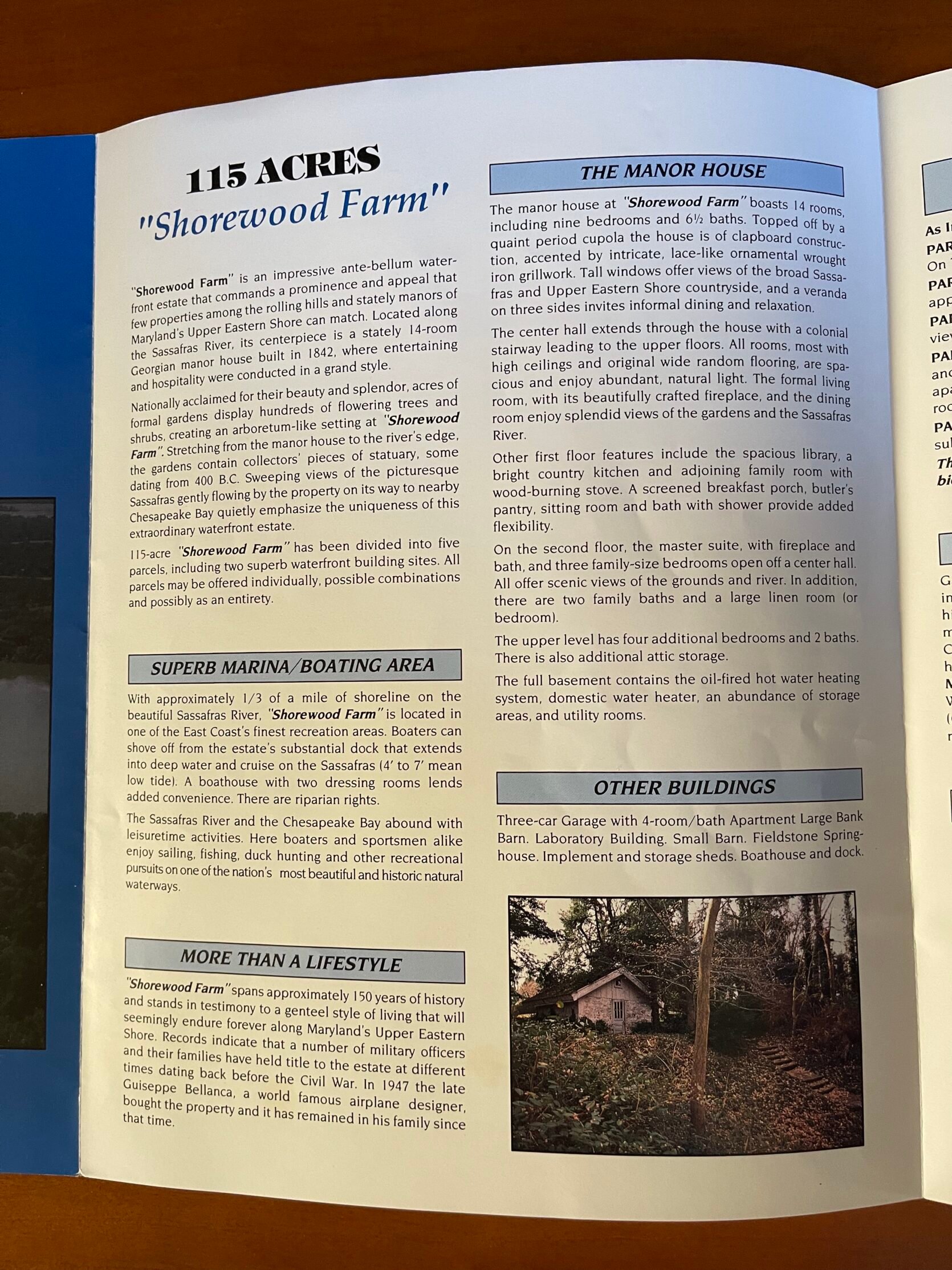

And if you’re like, “hey, what the **** is Brenda talking about,” please know that I WAS IN THE EXACT SAME BOAT. The story – which had somehow never come up between us in the 30 years I’ve been alive – went like this: in 1992, my dad dragged my mom to an auction for an enormous 18 acre, 14 room, 9 bed, 6.5 bath, mid-1800s money pit. (Adjusted for inflation, even I, in 2022, would have been able to buy this home and its surrounding acreage with my current budget.)

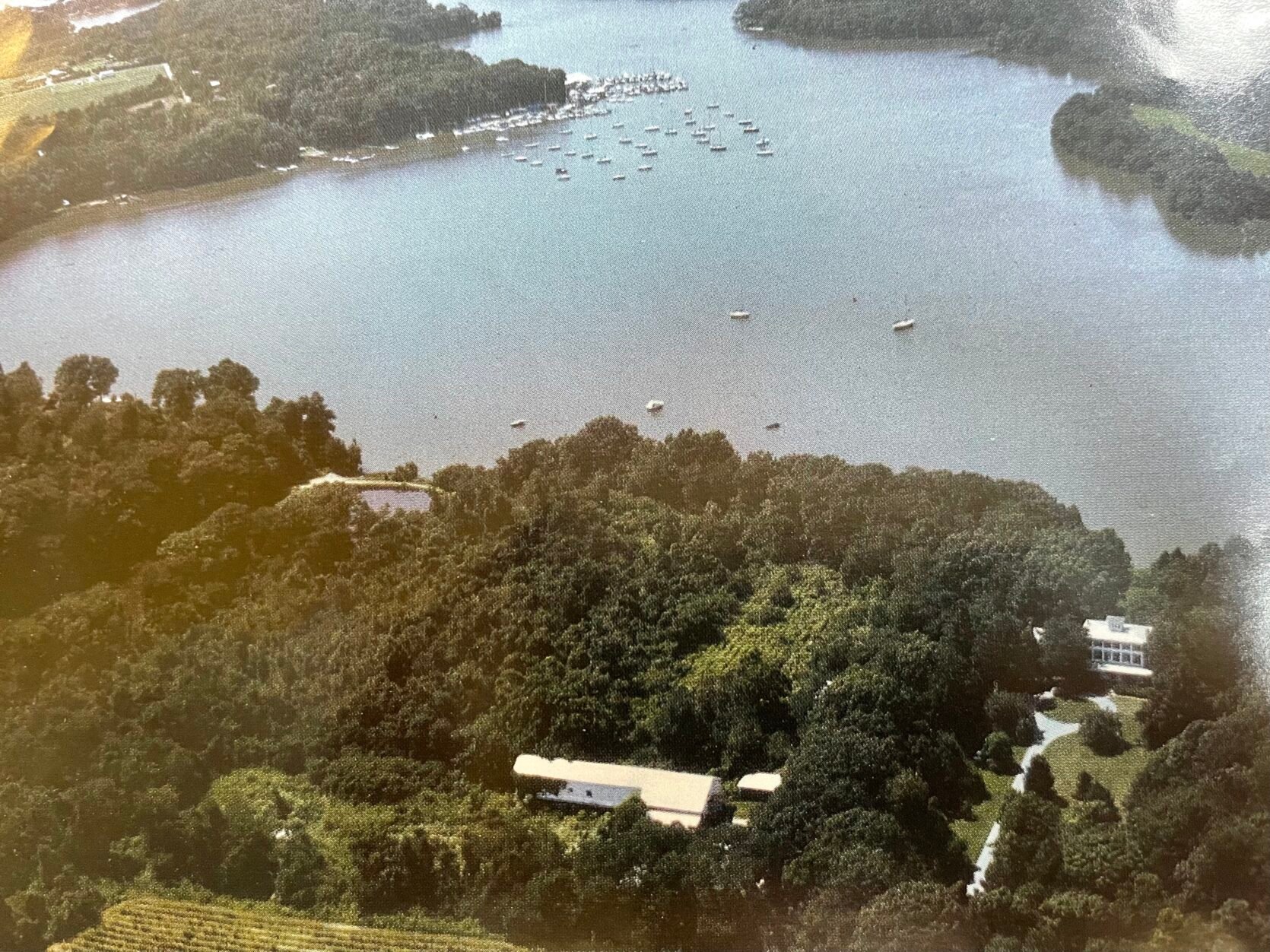

The mansion – or the “manor house,” as the auctioneers called it – was just a portion of a 115 acre estate that had formerly belonged to a world-famous aviator. The airplane magnate – who even graced the cover of Time Magazine in the ’20s! – had passed away in the 1960s and the entirety of his property had fallen into disrepair. His land was split into 5 separate parcels and was being sold for pennies on the dollar.

The manor house (lot 2 of 5) was affordable, but it was also a massive, years-long renovation project – especially for a couple with two full-time jobs, one cancer diagnosis (my dad’s), and a 6-month-old newborn baby (me, obviously). My parents were not dissuaded. “Let’s buy this house today,” said my dad. “Okay,” said my mom.

Now, if you’re familiar with my own house hunting journey over the past few years – from the similarly, uh, let’s call it…project-heavy? hill house, to the 1970s time capsule, to the sight-unseen offers – my father’s cavalier approach may ring a liiiiiittle bit of a bell. The rollercoaster may sound familiar, too – my parent’s offer was accepted, but the contract fell through after a brief legal battle (the seller no longer wanted to sell). My dad passed just a year later; Brenda and I moved in to a new build home. The manor house, in a lot of ways, is my mom’s own version of the hill house – a home that almost was – but her story had unfolded 30 years earlier.

There’s been some interesting scientific research which suggests that folks can be genetically predisposed to inheriting set levels of happiness or resilience or optimism. I don’t remember anything about my dad – I was too young when he died – but I seem to have inherited something else from him: a one-track mind with a real determination to complete a complicated, nightmarish, rewarding renovation project. (Along with a desire to rope Brenda in on said project – though her willingness to stand by me as I fell in love with money pit after money pit now kind of makes sense, doesn’t it? History doesn’t repeat, but it does rhyme…and I’m here with some genetically-inherited unfinished business, apparently.)

Which brings us to the real point of today’s post – because guys, finding a fixer-upper in the continental United States didn’t seem challenging or confusing or stressful enough. WE’RE GOING INTERNATIONAL. (Yeah, we. Me and you. All of us. We’re in this together now.) Let me catch you up to speed on what’s happened over the past year, yeah?

I’m Priced Out of LA (At Least For Now)

I know concepts like “being priced out of a market” can be kind of big and abstract, so I wanted to pull some actual, real-time numbers for you. You know how many homes are on the market in my price range in Los Angeles right now? And we’re talking about a huge search radius here – from North Hollywood to Pasadena to Boyle Heights. (If you’re not from LA – this is a far bigger stretch of area than I’d been searching in previously.) Anyone wanna take a quick guess?

SIX. In a city with between 4 and 18 million people (you know, depending on what you consider to be LA), there are SIX HOMES available under $575,000 in my newly-expanded 130+ square mile search radius. But it gets better (or bleaker, depending on how schadenfreude-y you’re feeling):

- 1 is a cash-only probate sale.

- 1 is tenant-occupied.

- 1 is a cash-only probate sale AND it’ll be delivered tenant-occupied.

- 1 is cash-only for investors.

- So then, there were 2…

And they’re fine. I’m sure they’ll make one of the 18 million people in the greater LA area very happy! They’re just not the right home for me, you know? I love Los Angeles – I’ll be celebrating 10 years here at the end of May, and I want to stay for the rest of my life – but unless I (a.) win the lottery or (b.) find a rich benefactor, buying real estate and laying down my permanent roots here just doesn’t seem like it’s in the cards for me. But seeing as I’d like to, you know, own a home before I’m deceased, I figured that I should start changing up my strategy.

I Reconsidered My Priorities

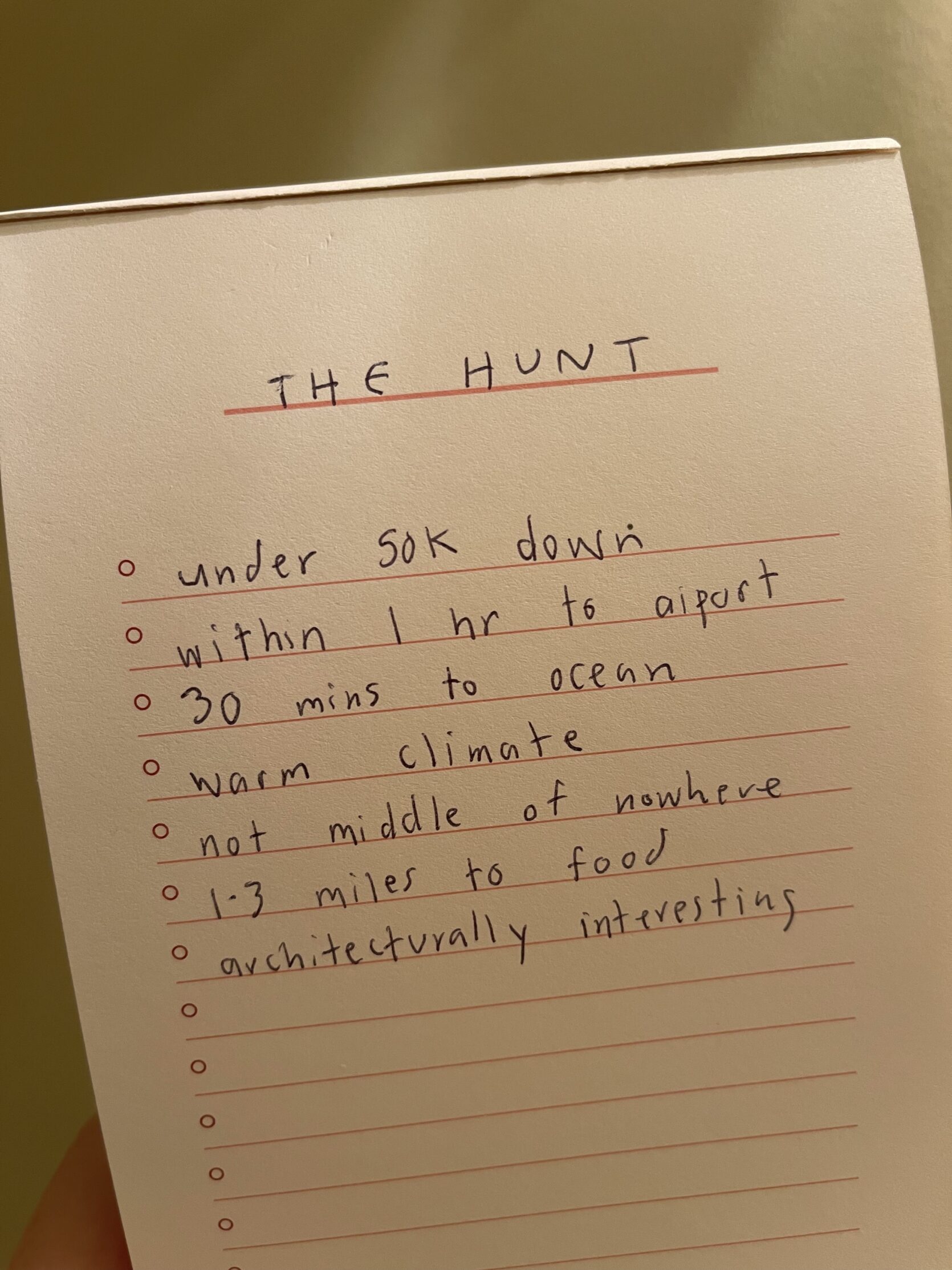

This process may also be known by its more colloquial name, “the reality check.” I started to consider searching elsewhere – just like Ajai did, after her year-long search in LA – with the hopes of keeping my apartment and balancing my current rent with a mortgage on a “vacation” property. I ran the numbers, planned a budget, and came up with my own list of nice-to-haves.

This is where I landed. The gist, in case you can’t read my handwriting was as follows: affordable, architecturally interesting, warm, and not in the middle of nowhere.

Now feels like the time to clarify that my goal for homeownership has never been to diversify my investments or to accumulate wealth or to climb some sort of socioeconomic ladder – I simply want a stable place to call my own, forever. And for that reason, I started to think that maybe this idea for a vacation property was better – you know, prioritizing a smaller, more manageable destination that I’d be able to share and enjoy with friends and loved ones. It felt like a more – I don’t know, fun, maybe? use of capital when I compared it to buying a home just for me.

But true to form, I’ve never been great at thinking small (which, from here on out, I will blame on genetics). If I was going to invest in a property to share with my friends – most of whom already live in some of the most dynamic and beautiful cities across America – why not just do a quick check search in, uh, some actual vacation destinations in other parts of the world? No harm there, right? (Those will be my famous last words, I think.)

I Did My (Admittedly Boring & Unglamorous) Research

So in April, I threw myself deep in to learning the ins-and-outs of international real estate. I wasn’t trying to pull a Say Yes to The Dress here – like, when you fall in love with something totally unattainable and spend the rest of your life yearning for the impossible – so I’d pick a destination and then pull as much information as I could find about the seven following questions. If you’re interested in buying internationally, I found these to be the best places to start, too. It’s high level and by no means totally comprehensive, but hopefully it’ll be a little helpful as a jumping off point 🙂

- Where can I buy? Some countries allow foreigners the same purchasing rights as citizens; others limit the property type, size, or locations available.

- How long can you stay? Oh, Schengen zone. Ah, 90/180 rule (read: you can stay 90 days every 180 days). That was okay for me – I love LA and don’t need to move permanently! – but it may affect where you choose to search.

- Is financing available at all? Transparently, I’m looking to buy in cash (and it’s possible – for way less than I’d spend on a comparable property in America!). But there are lots of options for financing, too. Most folks work with local lenders (albeit with terms much different than we’re used to here in the US). There are also a few international banks who offer foreign mortgages in a select group of countries. But beyond that – and maybe most importantly – do you have the risk tolerance for fluctuating currencies? Will you be okay if the value of the dollar falls?

- What are the long term costs? As someone who is pretty intimately familiar with the property tax structure of LA, this one was a big sticking point for me. What do the usual, boring, recurring, long-term costs look like in your area of choice?

- How much would the international renovation process cost? Yeah, you do need to be pretty far into a process to find the folks with whom to have this discussion. Fortunately, I did make it pretty far, and I have a great benchmark number to reference (if you’re interested in the area where I landed, at least).

- Are there any benefits to your new location? Whether you’re looking for tax breaks, programs that help finance green renovations, paths to citizenship, or visas, there are a lot of incentives out there that can help you achieve your goals (whatever they are).

- What does weather look like? Simple? Yeah. And while an island home sounds amazing in theory, I don’t have the mental bandwidth to worry about hurricanes or sea levels or wind in a home that I’d only occupy part-time. So for me, zoning in on areas with temperate, mild climates became the name of the game.

Noticeably – and maybe foolishly – absent from my list is the question, “what does the rental market look like for tourists?” Turning a profit isn’t a priority for me – I think of this more as an investment in my own happiness vs. an investment to generate financial returns – but also…I’m still young and idealistic, so who knows? Maybe one day, I’ll come around. 🙂

So…We’re Going Global

I’m going to go ahead and give you the full Brenda experience here. (Because what fun is having a child if they don’t just blindside you once in a while?)

Here’s what happened: after months of research, I’d homed in (punny, I hope?) on southern Italy. Impossibly, it somehow checked all my boxes AND THEN SOME. Affordable fixers, a temperate climate (errr, temperate-ish. Full disclosure: Sicily did clock its hottest temperatures ever last year), airport and ocean proximity, walkable towns, and INCREDIBLE architectural interest. Beyond that, the townspeople I’d emailed were friendly, the property taxes were affordable, and the incentives and tax breaks for folks working on renovations were unprecedented. But that was August, and this is January. So what the heck happened???

This freaking pandemic, you guys. CAN’T WE ALL CATCH A BREAK? Like I had mentioned to Brenda in the earlier texts, Emily had surprised us with the first week of September off (one of the many perks of a kind boss!) and I’d hoped to cash in on some miles to fly over and check out a few sub-$50k USD fixers in person. The one you see pictured had captured my heart – and funnily enough, it was actually a hop, skip, and jump away from the town where that world famous aviator was born, which now feels like a very full circle moment – but I put my plans on hold after a surge in cases in the area led to a “do not travel” notice. While I’m vaccinated and comfortable flying, I wasn’t comfortable with the idea of being stranded for an indeterminate amount of time.

In the interim, I familiarized myself with the process even more. I chatted with local designers and architects to grab a renovation quote for the property in question, which came in around $700/sq meter. For my fellow Americans, let me break it down for you – that’s about $65 per square foot. (Yeah, I couldn’t believe it either.) The cost of the home? About $23,000. The cost for a full 1,400 square foot renovation? $91,000. Even with overages and taxes and potential emergencies and cross-contintental flights, this was still more affordable than the vacation properties I’d looked at in America by a number of multitudes.

Let me be clear: I’m not waltzing in and suggesting that buying dilapidated homes halfway around the world is easy or affordable (or that it’s even a good idea, TBH). But I am willing to trade comfort and ease and even my mental sanity in exchange for a long-term reward, so working towards this makes sense for me.

After my September plans fell through, I had hoped to fly out on our next EHD break: the week off between Christmas and New Years. Mileage redemptions are even better in the winter, I told myself. It’ll be even better! Maybe I’ll even be able to bring Brenda! My mom and I had spent our last pre-pandemic New Year’s Eve in Quebec. Perhaps, I hoped, we’d be able to spend our first post-pandemic holiday in Southern Italy. And, uh, I’m pretty sure you can guess how that one turned out. Pandemic: 2. Caitlin: 0.

So, Like, What’s Next?

Well, uh, the house I fell in love with – the one that I’d sent to Brenda, the one I’d hoped to visit first, the one that I’d gotten estimates for, the one I’d assembled a team around (and trust me, it takes a village!) – recently sold to another buyer. WOOF, RIGHT?

It’s okay, though. Have you ever felt like you’re moving in the right direction? Not to sound too ~woo woo~ (she wrote, after writing the wooiest woo woo post of all time), but my gut tells me that I’ve just been headed towards the big payoff. All these weird and niche experiences have been building up to…well, something. I’ve continued to search in Italy, have a few properties in my sights, and have built up my language more than I thought possible (9 months of daily practice, thanks Duolingo!).

I’ll get there when I get there, I guess. And when I finally do find my spot and get those keys, I can’t wait to force Brenda to stand by my side to witness the complicated, nightmarish, rewarding renovation project that she should have gotten to experience all those years ago. I mean…I do have some genetically inherited unfinished business, after all. 🙂

THAT’S IT FOR ME TODAY. But I’ll be back later this month with a full roundup of all the best sources and IG accounts I’ve found which compile affordable, old, architecturally interesting houses for sale worldwide. (That was actually supposed to be the topic of this post, but, well, sometimes your fingers are flyin’ and then you’re accidentally 10 pages deep on a personal essay. C’EST LA VIE. Or, more appropriately, COSÌ È LA VITA.) As always, I appreciate you indulging me. Please let me know if you have any burning questions – I have nearly a year’s worth of research up in this noggin!!! – and feel free to drop any advice or words of caution if you’ve been through this process.

Here’s to all of us finally getting what we’ve been working for in 2022. Happy Friday. Sorry for making you listen to my story about my dead family (hope the payoff was worth it). xx

Opening Image Credit (the bathroom): Design and Model by Caitlin Higgins | Styled by Emily Bowser | Photo by Sara Ligorria-Tramp | From: Caitlin’s First MOTO Reveal – A Vintage Bathroom Gets A Modern Update

THIS POST WAS ORIGINALLY PUBLISHED HERE.